how much does the uk raise in taxes

Prime Minister Boris Johnson has also ruled out cuts to public services and pledged not to go back. It wishes to be the party of sound public finances but also wants to avoid raising taxes.

Boris Johnson And Rishi Sunak Have Announced Tax Rises Worth 2 Of Gdp In Just Two Years The Same As Tony Blair And Gordon Brown Did In Ten Institute For

A uniform Land tax originally was introduced in England during the late 17th century formed the main source of government revenue throughout the 18th century and the early 19th century.

. Pump prices are rising in the UK. By 2025 26 billion people will have access to. It would need to impose a permanent annual increase in taxes or cut in spending equal to 43 per cent of GDP 84bn in todays money in 2022-23.

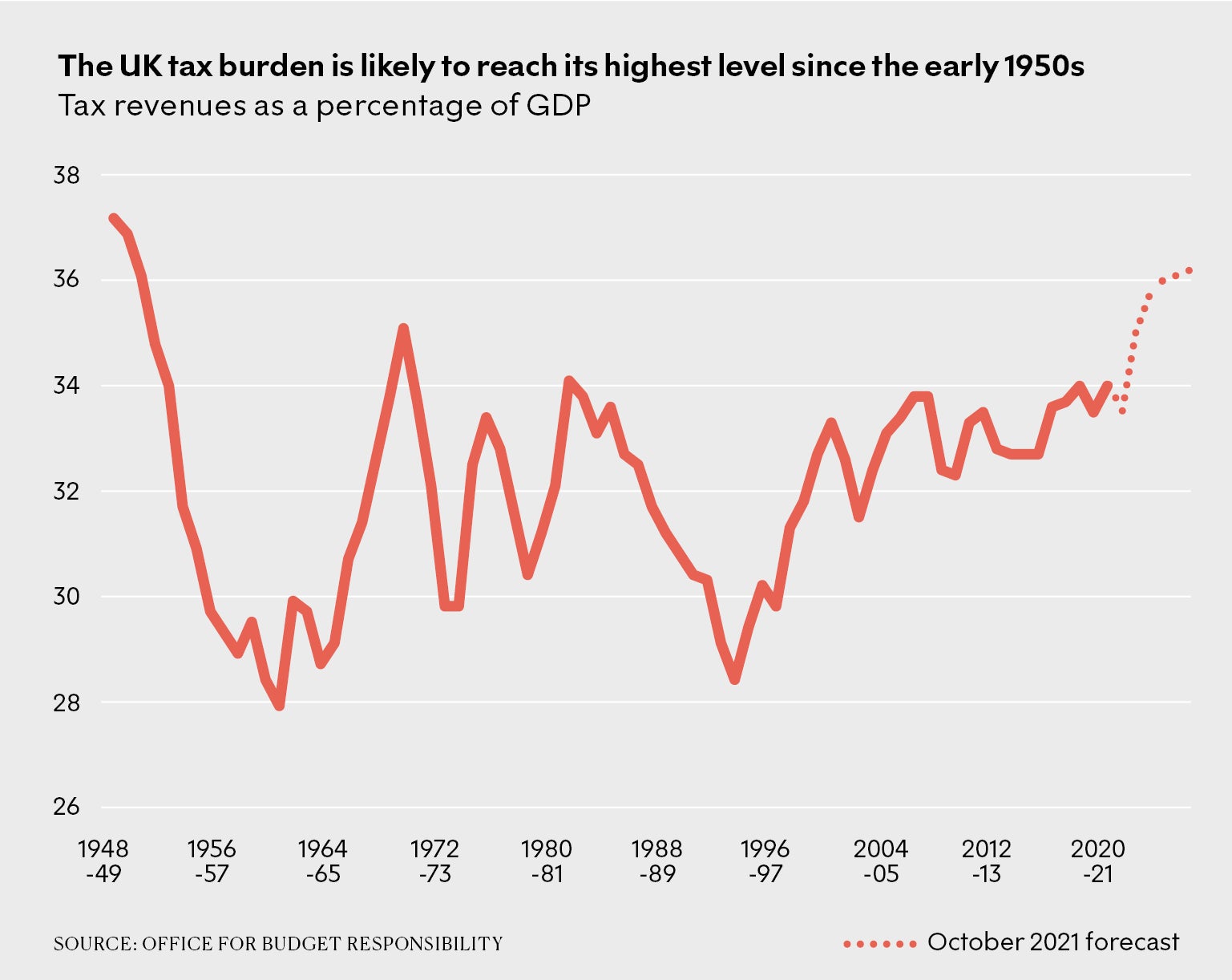

This is slightly below the average for both the OECD. This is equivalent to around 39 of the size of the UK economy. From 6 July workers will be able to earn 12570 a year before they have to start paying NI - up from the previous threshold of 9880.

The poorest 10 pay 4000 in tax mostly indirect VAT excise duty. In line with inflation there will be an increase in allowances and the basic rate limit. With the potential to raise 70bn a year 8 of total tax revenues taken by the government the financial benefits do add up while the criticisms of wealth taxes simply dont.

From 229 in total income taxes it is anticipated that receipts will increase. Income tax was announced in Britain by William Pitt the Younger in his budget of December 1798 and introduced in 1799 to pay for weapons and equipment in. In the previous 12 months they would have paid 4852.

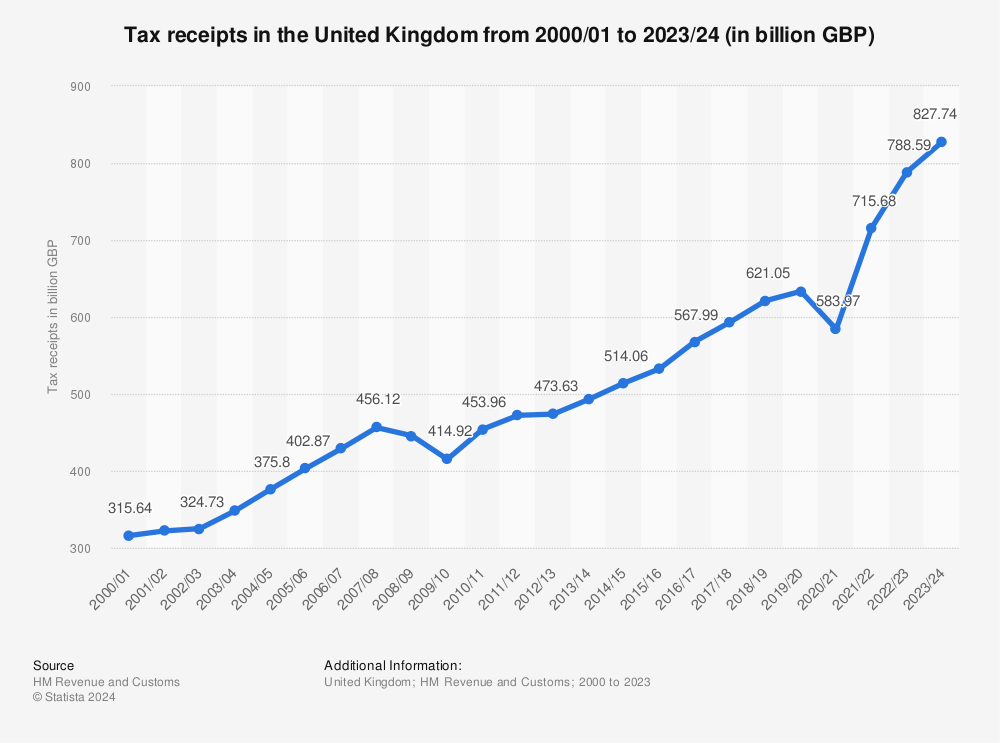

The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-. The weeks since Russias invasion of Ukraine have seen a rise in road fuel prices in the UK. In 202122 UK government raised over 915 billion a year in receipts income from taxes and other sources.

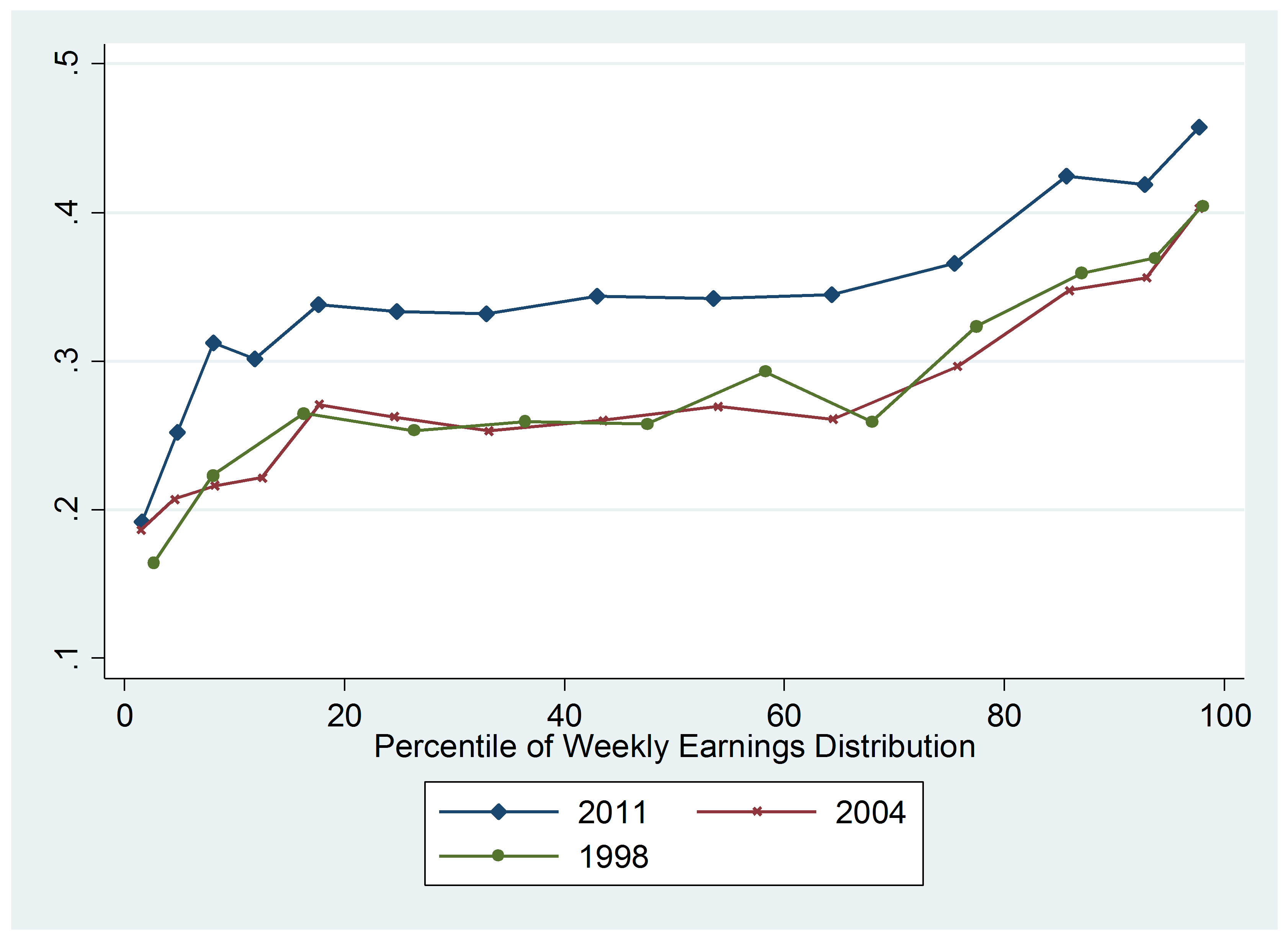

For the 202223 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45. United Kingdom UK finance minister Sunak resigns article with image July 5 2022 United Kingdom British health minister Javid resigns plunging government into chaos article. The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system.

This comparison shows that instead. Tax on share dividends will also be increased by 125 percentage points in a move expected to raise 600m. 1 day agoIn the year from April 2022 a worker on 50000 will pay 5049 in National Insurance.

This briefing note provides background material for the 2017 general election. How much does the UK government spend each year. UK Government Expenditure Statistics.

In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when. From 168 billion in 202122 to 6 billion in 202223. This represented a net increase of over 402 billion pounds when.

How much does the UK raise in tax compared to other countries. Government expenditure as a percentage of GDP in the United Kingdom was at 354 in. But receive over 5000 in tax credits and benefits.

Under current plans the share of national income raised in taxes is set to reach its highest. UK tax revenues were equivalent to 33 of GDP in 2019. Alternatively the government could achieve.

As of 7 March the estimated average pump price. A 1 tax on the use of the policy would be raised by Labour the party claimed. That would be an extra 91000 in tax revenue per person.

In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. The richest 10 pay over 30000 in tax mostly direct. Much of the revenue initially will be devoted to cutting waiting lists in.

1 day agoBy increasing the threshold the former Chancellor said around 70 per cent of workers will actually have their tax cut by more than the increase coming in April. This change will bring NI in line with the personal. Taxes as defined in the National Accounts are forecast to raise 6229 billion equivalent to roughly.

The Rise Of High Tax Britain New Statesman

People Are Making Fun Of Rich People Who Are Afraid Of Biden S Tax Plan 46 Pics Cool Things To Make How To Plan Rich People

Did Onondaga County Residents Win Or Lose In First Year Of U S Income Tax Reform First Stats Are In Income Tax Onondaga County Income

Average U S Income Tax Rate By Income Percentile 2019 Statista

How Do Income Taxes Affect The Economy Tax Foundation

Virtual Assistant Tax Tips The Free Mama Lauren Golden Virtual Assistant Virtual Assistant Business Small Business Marketing Plan

How Do Taxes Affect Income Inequality Tax Policy Center

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others

How To Pay Taxes On A Credit Card And Get Rewards Business Credit Cards Credit Card Payoff Plan Credit Card

How Do Taxes Affect Income Inequality Tax Policy Center

Richard Burgon Mp On Twitter Richard Investing Twitter

Pin On Making Money Online The Right Way For Anyone

What Are The Consequences Of The New Us International Tax System Tax Policy Center

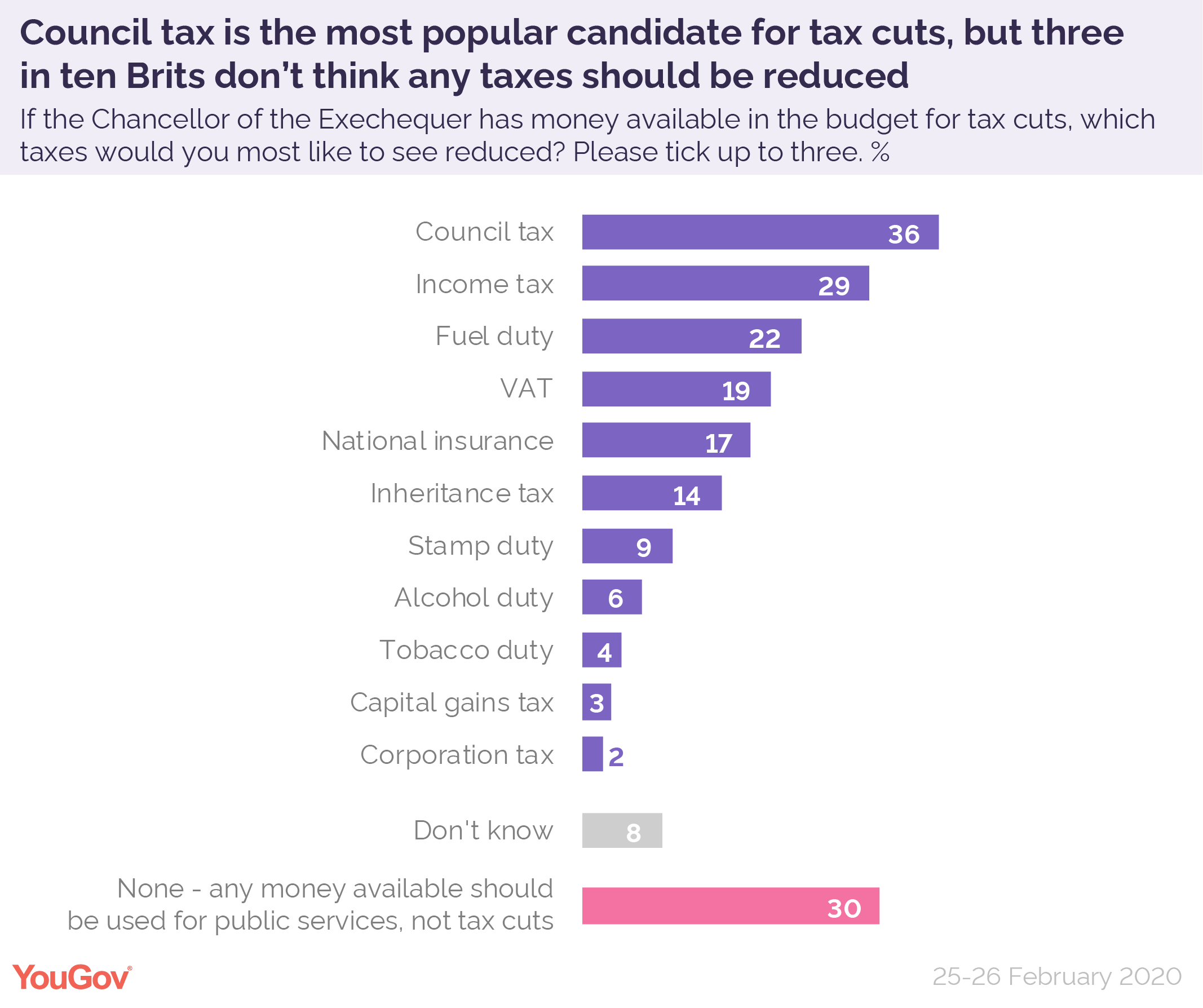

Budget 2020 What Tax Changes Would Be Popular Yougov

The Top Rate Of Income Tax British Politics And Policy At Lse

Scott S Skin In The Game Plan Could Raise Taxes By 100 Billion In 2022 Mostly On Low And Moderate Income Households

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget