dc auto sales tax

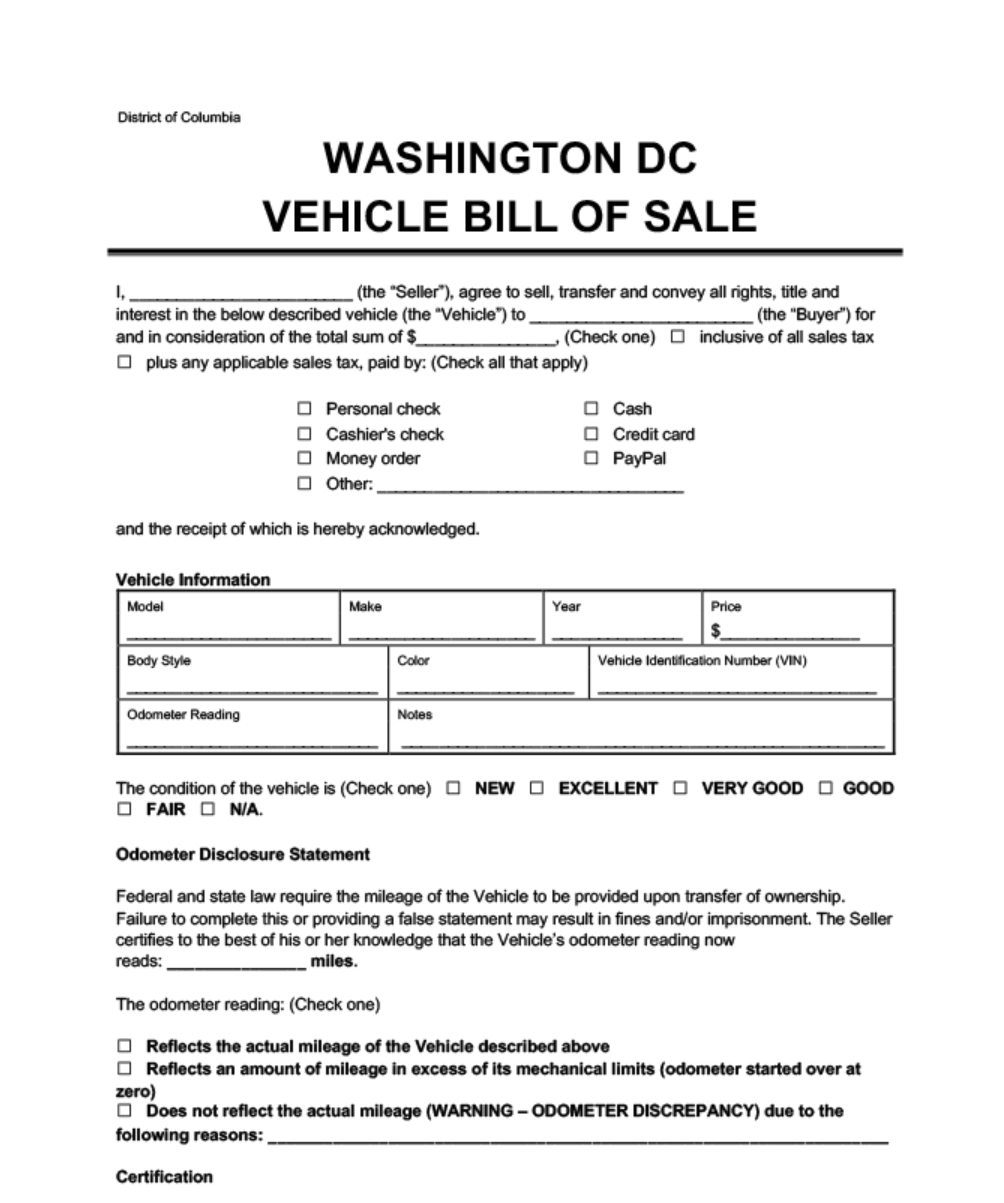

Tax rates can vary based on the location of your business and the location of your customer plus the levels of sales tax that apply in those specific locations. For private sales you should also obtain a bill of sale.

Aaa Oregon Idaho And Oregon Trucking Association Challenge Oregon Tax On Vehicle Sales That Would Fund Electric Car Rebates Portland Business Journal

District of Columbia has a statewide sales tax rate of 6 which has been in place since 1949.

. Use tax is imposed at the same rate as the sales tax. District of Columbia has a 6 statewide sales tax rate. Make sure you know whether the vehicles sales price includes the Districts excise tax.

1101 4th Street SW Suite 270 West Washington DC. Motor vehicle dealers and motor vehicle leasing companies must collect the additional sales tax of three-tenths of one percent 03 of the selling price on every retail sale rental or lease of a. Title 47 Chapters 20 and 22.

The printed names and addresses of the seller and purchaser. Special Considerations for Leases and Liens If your. Except as set forth in DC.

Title 47 Chapters 20 and 22. To register a vehicle that weighs 55000 lbs or more you will have to pay a Heavy Vehicle Use Tax. Official Code 50-220103 j 1A G the excise tax rate on motor vehicles shall be as follows based on vehicle weight class and miles per gallon mpg city.

Sales and use tax rate for leased vehicles rose Oct. New Sales and Use Tax Rates Effective October 1 Friday September 30 2011 Washington DC - Effective October 1 an increase in the District of Columbia Sales and Use. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

1 in DC Effective October 1 the Washington DC Office of Tax and Revenue increased the sales and use tax rate to 1025. Review our excise tax exemption list Rates are. In addition there are also four tiers of excise taxes levied against a new car or truck.

The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. Review our excise tax exemption list Rates are. Masks are still required at DC.

60 - General rate for tangible personal property and. The details contained within a Washington DC bill of sale template include but are not limited to the following. A sales tax of 6 percent is charged on the MSRP of any new vehicle purchased in Washington DC.

Monday to Friday 9 am to 4 pm except District holidays. Exact tax amount may vary for different items The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575. Current Tax Rate s The rate structure for sales and use tax that is presently in effect.

There are few exceptions to this. Estate Tax Brochure PDF Certificate of Clean Hands Brochure PDF Contact Us For assistance with MyTaxDCgov or account-related questions please contact our e-Services Unit at 202. Unlike many other states District of Columbia doesnt allow municipal governments to collect a.

Most new car dealerships will collect the excise. The state-wide sales tax in. Office of Tax and Revenue.

Office of Tax and Revenue Office Hours Monday to Friday 9 am to 4 pm except District holidays Connect With Us 1101 4th Street SW Suite 270 West Washington DC 20024 Phone. The District of Columbia state sales tax rate is 575 and the average DC sales tax after local surtaxes is 575. Sales tax rates updated monthly Our team of 100 researchers keeps our database up to date with the latest in rates and taxability rules for each jurisdiction.

Vehicle Registration For Military Families Military Com

How The Car Market Is Shedding Light On A Key Inflation Question The New York Times

![]()

Lithia Chrysler Dodge Jeep Ram Fiat Of Roseburg New Used Dealership

Martin Austermuhle On Twitter D C S Income Tax Structure Is Rated As Being Progressive The Rich Pay More As A Share Of Their Wealth Though Sales Excise And Property Taxes Are Regressive Https T Co Zzxzhgggbi

Virginia Sales Tax On Cars Everything You Need To Know

Free Washington D C Motor Vehicle Bill Of Sale Form Pdf Word Eforms

/cloudfront-us-east-1.images.arcpublishing.com/gray/6LEY6LSRAZBIRA5YE7BTIDOMBU.jpg)

Jackson Co Officials Propose Lowering Auto Sales Tax

Get Washington D C Auto Bill Of Sale Form Usedautobillofsale Com

Changes To The Exemption Application Process Starting November Mytax Dc Gov

Welcome To Mercedes Benz Of Fredericksburg In Virginia

Washington D C And Federal Tax Credits For Electric Vehicles Pohanka Automotive Group

Universal Motors Home Facebook

Dc Motors Used Cars Northwood Oh Used Bhph Cars Oregon Oh Bad Credit Car Dealer Northwood Oh Pre Owned Bhph Autos Oregon Oh Previously Owned Vehicles Northwood Oh Used Suvs Oregon Oh Used Bhph Trucks Northwood Oh Used

Ohio Annual Sales Tax Holiday To Give Shoppers A Break

Ramey Motors Inc New Gmc Buick Chevrolet Dealership In Princeton Wv

Car Tax By State Usa Manual Car Sales Tax Calculator

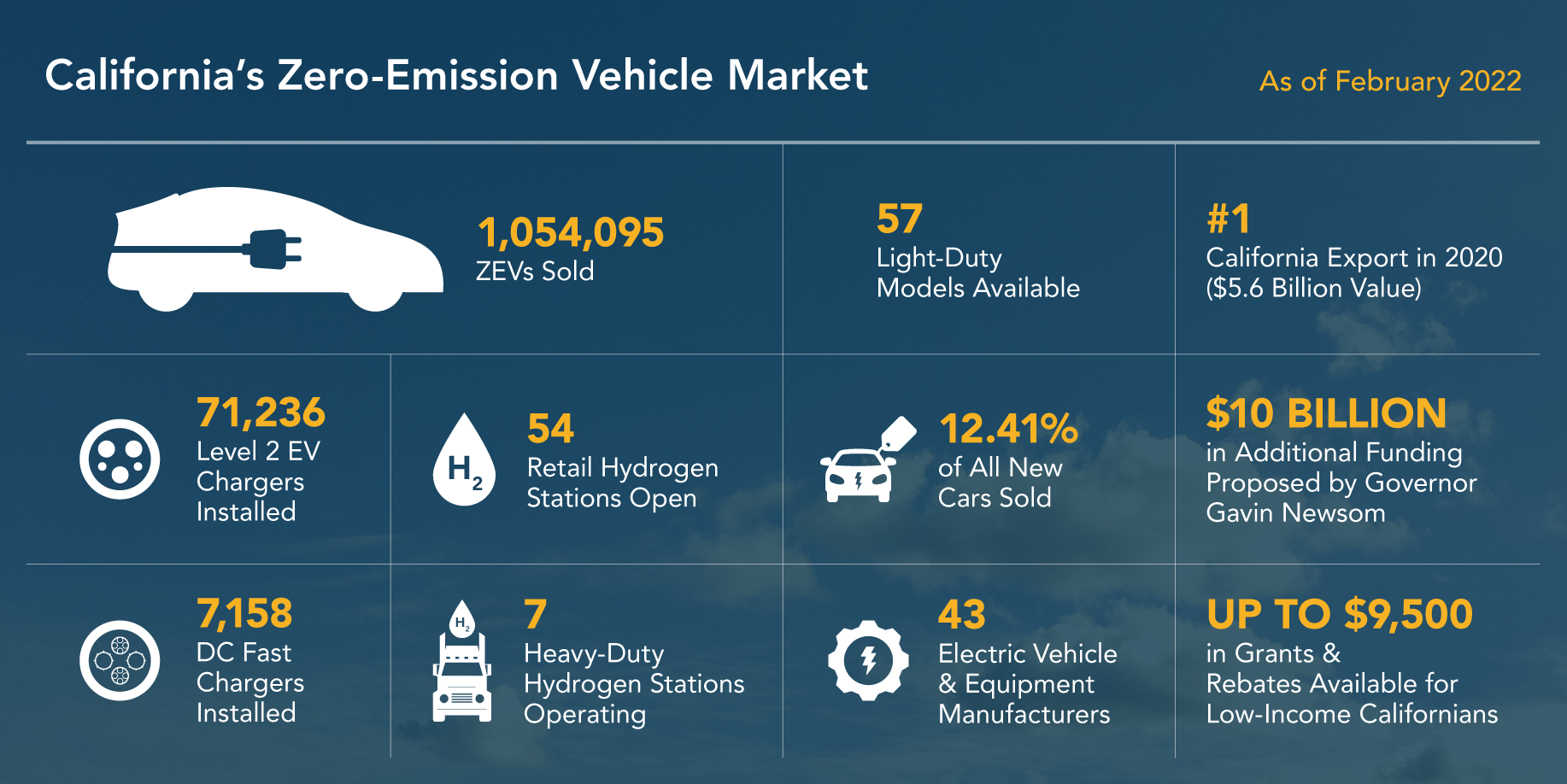

California Leads The Nation S Zev Market Surpassing 1 Million Electric Vehicles Sold California Governor

/cloudfront-us-east-1.images.arcpublishing.com/gray/XSTHRDSMWNHMDJWDIO3WD5W7LA.png)